Any company requires an efficient method of invoicing customers, registering transactions, and storing money. However, not every invoice is the same. You must have the appropriate type of invoice depending on the circumstances, such as quoting work, part payments, correcting a bill or closing a project. It is simple and requires no advanced accounting software because a free online invoice generator gives you the opportunity to select a particular invoice style and complete it immediately.

In this guide, you will know the various types of invoices and when to apply any of the invoices, hence you will never have to make mistakes in billing clients and will always have a smooth journey with them.

Why Knowing Invoice Types Matters

Matching invoice type to the situation

When the incorrect invoice format is used, it may result in mix-ups, disagreements or late payments. Considering the case of the standard invoice being sent when the job has not been completed yet, this can be confusing to the clients who would have been expecting a quotation first. The choice of invoice type is a way of making your plans on billing crystal clear on the first page.

Better records and compliance

Some of the invoices are legally bound invoices - particularly the GST / VAT invoices. It is beneficial to businesses, to know which invoice to send:

- Keep impeccable accounting documentation.

- Stay tax-compliant

- No arguments in audits or bookkeeping.

Knowing the types of invoices is one way of keeping yourself clean and gaining credibility with your clients.

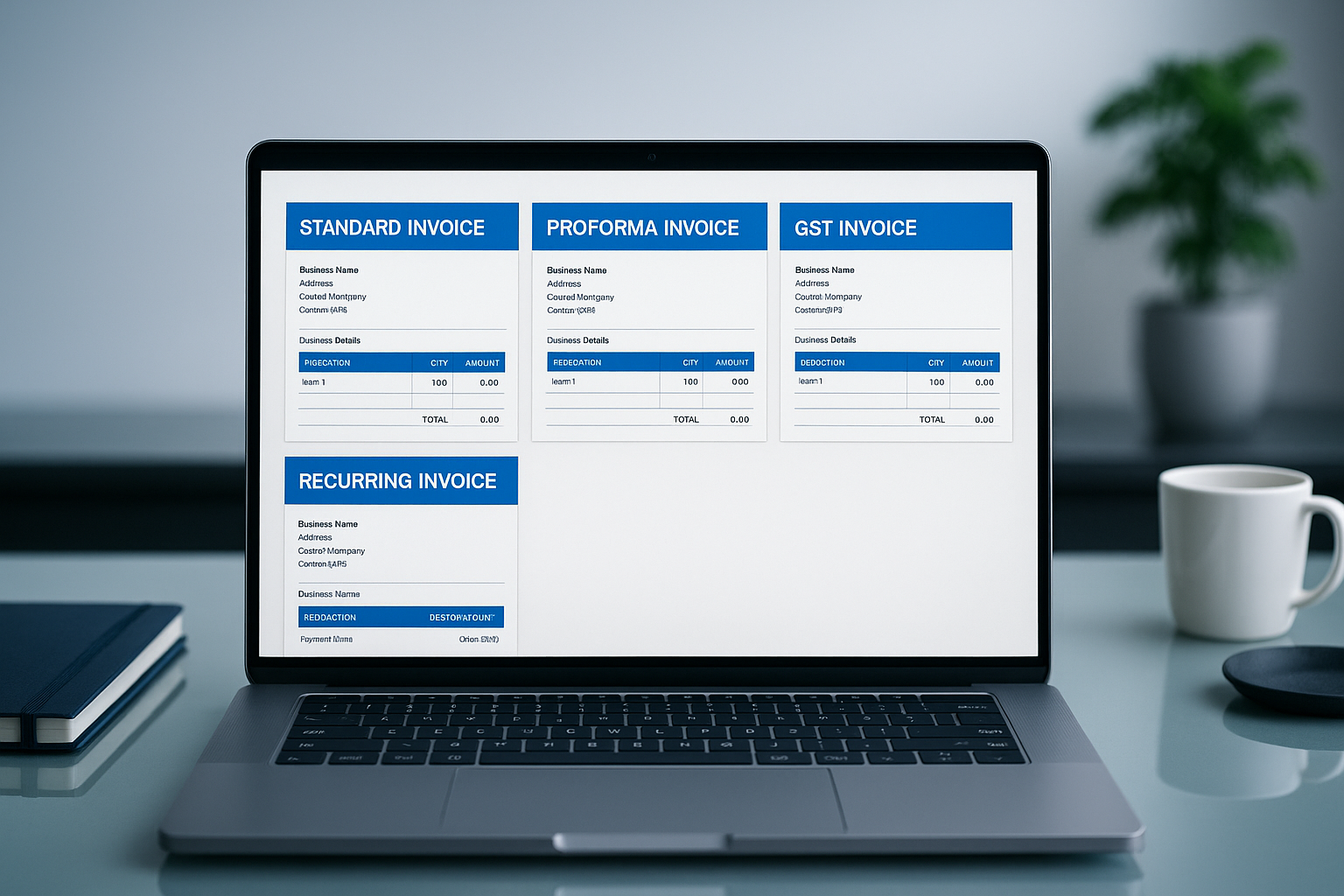

Common Invoice Types Explained

A web-based invoice generator will offer pre-structured invoice templates for various billing scenarios. The most common type of invoices and their meaning include:

Standard Invoice

The most typical way of billing a product or service is the use of a standard invoice. It includes:

- Business and client details

- Itemised work or goods

- Tax and discount information

- Total amount due

It is normally applied by freelancers, shopkeepers, agencies, and service providers to do their day-to-day billing.

Proforma Invoice

A pro forma invoice is not a finished request for payment. It is applied as a quotation or estimate to give the client a clear idea of the costs they should expect before finally issuing the invoice.

Examples:

- Bid price for developing the website

- An estimated quote to receive bulk orders of products

After the client has confirmed the proforma invoice, a tax or standard invoice could be prepared.

GST / Tax Invoice

When the business has to display the tax separately on the bill, then the invoice is necessitated by a GST or VAT invoice.

Key fields include:

- GSTIN / VAT registration number

- Tax rate (%)

- CGST, SGST, or IGST breakdown (for India)

- HSN / SAC codes (if applicable)

This type of invoice assists in complying and is necessary for businesses registered according to the tax laws.

Recurring Invoice

A recurrent invoice is best when the clients are paying on a daily, weekly or monthly basis due to a continuous job.

Example uses:

- Marketing services retainer per month

- Subscription-based business

- IT support plans

Repeat invoices are also time-saving as the billing cycle repeats itself without a new beginning.

Credit Note

A credit note is issued in case an invoice has to be corrected or refunded.

You may issue a credit note if:

- You overcharged the client

- A product was returned

- A discount was added after billing

It updates the previous invoice without cancelling the payment history.

Debit Note

A debit note is generated in situations where there are extra charges that require being added to an invoice.

Examples:

- Additional services not included in the first estimate

- Growth in the quantity of supplied products

It is transparent and assists in avoiding misunderstanding.

Advance Payment Invoice

This is the invoice that is issued when you want to receive partial payment before commencing work or delivery of goods. It is common in:

- Custom projects

- Bulk orders

- Service industries

The advance deduction is maintained in the final invoice.

Final Invoice

The last invoice is made when the project or order has been completed.

It summarises:

- Previous payments (if any)

- Balance amount due

- Final deliverables

This type is used to close a job and helps with recordkeeping and confirmation.

How an Online Invoice Generator Handles Different Invoice Types

An online invoice maker makes billing simple. It helps you:

- Choose invoice templates based on type (standard, GST, proforma, etc.)

- Auto-fill repeated details like client and business information

- Automatically calculate totals and taxes to avoid mistakes

Ready-to-use templates do not require you to create invoices manually, nor should you be worried about excluding other essential fields.

Choosing the Right Invoice Template for Your Business

Different businesses have different billing needs. Here’s a quick guide:

| Business Type | Most Suitable Invoice Types |

|---|---|

| Freelancers / Consultants | Standard Invoice, Recurring Invoice, Final Invoice |

| Product Sellers / E-commerce | GST / Tax Invoice, Standard Invoice, Debit/Credit Note |

| Agencies / Service Providers | Proforma Invoice, Recurring Invoice, Final Invoice |

| Bulk or Custom Orders | Proforma Invoice + Advance Payment Invoice |

| Subscription-based services | Recurring Invoice + Final Invoice |

Using the right template helps reduce confusion and speeds up payment approval.

FAQs About Invoice Types

- Is it possible to change a proforma invoice into a tax invoice?

- Are freelancers required to have a GST invoice?

Yes. After the client is satisfied with the quotation, you can transform the proforma invoice into a GST/tax invoice with the final service or product details and tax fields added to it.

Yes, as long as you are registered under the GST/VAT law. Otherwise, any normal invoice without GST fields is possible.

Conclusion

The knowledge of invoice types can make you bill properly, keep things organised and prevent conflicts. You can be a small business, a freelance service, a shop, an agency or any other type of business, but the correct format of invoice makes the process of payment faster and helps to build a trustworthy relationship with clients.

Do you need to know all the types of invoices: standard, GST, proforma, recurring, advance, and others? The free online invoice generator of Billdesk.app can help. Select a template, enter your information and download a clean PDF invoice without any installation or sign-up.

Professional billing does not require complicated software; Billdesk.app simplifies it quickly and for free